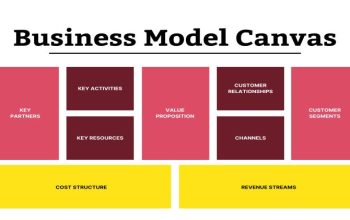

A well-structured business budget is more than just a financial tool—it’s a blueprint for sustainable growth. Whether you’re launching a startup, managing a small business, or scaling an established company, a clear budget helps you allocate resources efficiently, anticipate challenges, and make informed decisions.

Many business owners, especially first-timers, shy away from budgeting because it seems overwhelming. But in reality, creating a business budget can be straightforward if approached step-by-step.

In this guide, you’ll learn how to build a business budget that actually works—and how to use it to keep your finances healthy and your goals on track.

Why a Budget Matters for Business Success

A budget provides clarity and control. It:

- Tracks income and expenses

- Identifies profit margins and loss areas

- Helps set realistic financial goals

- Informs spending, hiring, and investment decisions

- Aids in preparing for tax season or funding pitches

Without a budget, you risk overspending, underestimating costs, or missing opportunities to scale strategically.

Step 1: Identify Your Income Sources

Start by listing all expected revenue streams. For a product-based business, this might include direct sales, wholesale deals, or online platforms. Service-based companies should account for client retainers, hourly billing, and passive income like online courses.

Tip: Use historical data if available. If you’re just starting, base estimates on industry research and realistic projections.

Step 2: List Fixed Costs

Fixed costs are expenses that remain the same each month or quarter. These include:

- Rent or mortgage

- Employee salaries

- Insurance

- Loan repayments

- Software subscriptions

Knowing your fixed obligations helps you determine your monthly break-even point.

Step 3: Estimate Variable Costs

Variable costs fluctuate with your business activity. These include:

- Raw materials or inventory

- Packaging and shipping

- Sales commissions

- Utilities

- Marketing and advertising

Monitor these regularly and adjust as your business scales.

Step 4: Include One-Time and Seasonal Expenses

Don’t overlook occasional or seasonal expenses like:

- Equipment upgrades

- Trade shows

- Holiday bonuses

- Annual license renewals

Spread these costs across months to avoid sudden budget shocks.

Step 5: Set Financial Goals

Create short- and long-term goals tied to your budget. Examples:

- Increase monthly revenue by 15% in Q3

- Cut marketing costs by 20%

- Save for a new hire or office space within 6 months

Align spending and savings with these targets.

Step 6: Choose a Budgeting Tool or Format

Use spreadsheets, accounting software, or budgeting tools tailored for business:

- Spreadsheets (Google Sheets, Excel) – Great for customization

- QuickBooks, Xero – Ideal for integration with accounting

- Wave, FreshBooks – Good for small business owners with simple needs

Choose a system you’ll actually use regularly.

Step 7: Track and Adjust

Budgeting isn’t one-and-done. Review it monthly to:

- Compare actual income and expenses to your forecast

- Adjust projections based on performance

- Identify trends or areas for cost-cutting

If your revenue dips or costs spike, a dynamic budget allows you to pivot quickly.

Step 8: Plan for Profit

Your budget should ensure you’re not just covering expenses—but turning a profit. Factor in:

- Owner’s pay

- Emergency fund contributions

- Tax set-asides

- Reinvestment for growth

Profit isn’t what’s left over—it should be planned for upfront.

Conclusion

Creating a business budget that works isn’t about perfection—it’s about awareness, control, and adaptability. A solid budget empowers you to grow your business confidently, make smarter decisions, and prepare for both challenges and opportunities. With a little consistency, budgeting can become one of your most valuable business habits.

FAQ: How to Create a Business Budget That Works

1. How often should I update my business budget?

Monthly is ideal. Frequent updates help you stay aligned with real-time financial performance and make timely adjustments.

2. What’s the difference between fixed and variable costs?

Fixed costs remain consistent (e.g., rent, salaries), while variable costs fluctuate with production or sales (e.g., materials, shipping).

3. Do I need budgeting software for my business?

Not necessarily. Spreadsheets work well for simple budgets. However, budgeting software can save time and offer automated insights as your business grows.

4. What if my income is unpredictable?

Use a conservative revenue estimate based on your lowest earning months, and budget for flexibility by prioritizing essential expenses.

5. How much should I allocate for marketing?

A common rule is 5–10% of your revenue, though this can vary by industry. Track ROI and adjust based on performance.

6. Should I include taxes in my budget?

Absolutely. Set aside 15–30% of your income for taxes depending on your business structure and location. Consult a tax advisor for specifics.

7. How can I reduce costs without hurting my business?

Review subscriptions, renegotiate contracts, switch suppliers, or automate tasks to cut costs while maintaining efficiency.

8. What’s the best way to project income for a new business?

Use industry benchmarks, competitive research, and conservative estimates. Start small and adjust as you gain real sales data.

9. How do I handle unexpected expenses?

Build an emergency fund into your budget—ideally enough to cover 3–6 months of operating costs.

10. What’s the #1 mistake to avoid when budgeting?

Failing to track actual spending. A budget is only useful if you compare it regularly against real numbers and adjust accordingly.