Introduction

In business conversations, the terms profit and revenue are often used interchangeably—but they’re far from the same. While both are essential indicators of a company’s financial performance, understanding their differences is crucial for making smart business decisions. Revenue shows how much money your business brings in, while profit reveals how much you actually keep after expenses.

So, which one matters more in business—profit or revenue? The answer isn’t always straightforward. Let’s dive deeper to explore what each represents, how they influence your business success, and why both are critical in their own ways.

1. What is Revenue?

Revenue, often called sales or top-line income, is the total amount of money a business earns from selling its products or services before any expenses are deducted.

Formula:

Revenue = Price × Quantity Sold

For example, if you sell 1,000 shirts at $20 each, your revenue is $20,000.

Key points about revenue:

- It reflects business activity and market demand.

- High revenue doesn’t mean a company is profitable.

- It’s often the first number listed on the income statement.

2. What is Profit?

Profit is what’s left after all expenses are deducted from revenue. It’s commonly referred to as the bottom line and is the actual earnings a business can reinvest, save, or distribute to owners.

There are different types of profit:

- Gross Profit: Revenue minus cost of goods sold (COGS)

- Operating Profit: Gross profit minus operating expenses (like rent, salaries, utilities)

- Net Profit: Total revenue minus all expenses, taxes, and interest

Formula:

Profit = Revenue – Expenses

If your business makes $20,000 in revenue but spends $15,000 on costs, your profit is $5,000.

3. Key Differences Between Revenue and Profit

| Factor | Revenue | Profit |

|---|---|---|

| Definition | Total income from sales | Income left after all expenses |

| Reflects | Business volume and growth | Efficiency and financial health |

| Can be misleading? | Yes, if costs are high | Less likely, as it factors expenses |

| Role in valuation | Used in growth metrics | Used in profitability analysis |

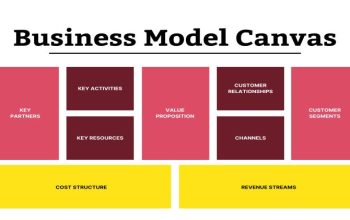

4. Why Revenue Matters

- Growth Indicator: Increasing revenue suggests strong market demand.

- Investor Attraction: High revenue can attract investors, especially for startups.

- Top-Line Focus: Businesses with long-term strategies often aim to scale revenue first.

- Sales Strategy Impact: Revenue shows whether marketing and sales are working.

However: Without a solid cost structure, growing revenue can result in larger losses.

5. Why Profit Matters

- Sustainability: Profit is essential for long-term survival. A business can’t operate in the red forever.

- Cash Flow Health: Profit directly impacts the amount of usable income.

- Valuation Driver: Profitable companies generally have higher valuations.

- Ability to Reinvest: Only profit allows you to invest in growth, pay debts, or distribute dividends.

In short: Profit proves your business model works.

6. Real-World Examples

- Amazon (Early Years): Amazon operated at a loss for years while growing revenue aggressively. Their focus was on market dominance and scale before turning a profit.

- Small Businesses: A local bakery might have modest revenue but high profit margins due to efficient operations and low overhead costs.

These examples show that revenue can drive growth, but profit ensures stability.

7. Which One Should You Focus On?

Early-Stage Businesses:

Revenue is often the priority to prove demand, attract funding, and scale. Profit may be sacrificed temporarily for growth.

Established Businesses:

Profit becomes more important. Long-term success depends on consistent profitability and healthy margins.

Ideal Scenario:

Balance both. Grow revenue, but not at the cost of draining profits. Efficiency and scalability go hand in hand.

8. How to Improve Both Revenue and Profit

To grow revenue:

- Expand product or service offerings

- Improve marketing strategies

- Enter new markets or customer segments

- Increase prices (if justified)

To increase profit:

- Reduce operational costs

- Improve pricing and margins

- Eliminate unprofitable products or services

- Automate or streamline processes

Conclusion

Revenue and profit are both essential metrics, but they tell very different stories. Revenue shows how well you’re attracting customers; profit shows how well you’re managing your business. One without the other is unsustainable. The smartest businesses focus on growing revenue and protecting profits.

Whether you’re a startup chasing growth or a mature company seeking stability, understanding the balance between revenue and profit is key to building a thriving, long-lasting business.

FAQs: Profit vs. Revenue – What Matters More in Business?

1. What is the main difference between revenue and profit?

Revenue is the total amount of money a business earns from sales before any expenses. Profit is what remains after deducting all costs, including expenses, taxes, and interest.

2. Can a business have high revenue but low profit?

Yes. If operating costs, debts, or overhead expenses are high, a company can earn a lot in revenue but still have little to no profit—or even a loss.

3. Why is revenue called the “top line”?

Revenue is referred to as the “top line” because it appears at the top of the income statement. It represents the total sales or earnings before any deductions.

4. Why is profit called the “bottom line”?

Profit is the “bottom line” because it’s the final figure on the income statement after all expenses have been subtracted. It reflects the company’s actual earnings.

5. Which is more important—profit or revenue?

Both are important. Revenue drives growth and indicates market demand, while profit ensures long-term sustainability and financial health. For a balanced business, both need attention.

6. Can a business survive without profit?

Not long-term. A business may operate at a loss temporarily (e.g., during expansion), but sustained profitability is essential for survival, reinvestment, and paying stakeholders.

7. How can I increase revenue?

You can grow revenue by expanding your customer base, launching new products or services, improving marketing efforts, or increasing prices if the market supports it.

8. How can I increase profit without raising revenue?

Profit can be increased by reducing costs, streamlining operations, renegotiating supplier contracts, eliminating waste, or improving product margins.

9. Do investors care more about revenue or profit?

It depends. Early-stage investors may focus on revenue growth and market potential, while later-stage or conservative investors prioritize profitability and return on investment (ROI).

10. Should startups focus on profit from the beginning?

Startups often prioritize revenue and growth early on to gain market share. However, having a clear path to profitability is critical to long-term success and investor confidence.